How is Our Money Created?

And What Does That Have to Do with the Global Reserve Currency?

Article Highlights:

America’s money is created by the central bank and distributed throughout the financial system by individual banks working inside the framework of the central banking system.

The US dollar serves as the current global reserve currency and is used for trade payments between most countries.

The US can have trade deficits year after year because its dollar is the world’s reserve currency.

I graduated high school in 1975. America has had a trade deficit every year since then – expanding to multi-hundreds of billion-dollar deficits in recent decades. In fact, January 2022’s deficit set an all-time monthly high of $107.6 billion. For many years I scratched my head, wondering how we could have continuous trade deficits and when would we finally turn those deficits to surpluses? Afterall, how could any entity indefinitely spend more than it earned?

My question was answered following the Great Financial Crisis of 2008-2009, because making no sense to me, that event spurred me to study the financial system. I couldn’t understand why the financial system practically collapsed in a week, when the economy in which I was busy working at the time was doing fine.

Thus began a decade long adventure, attempting to understand what had happened. Ultimately, I learned that the flaw in my thinking was my belief that finances of a government function similar to finances of a household. Alas, such is not true, especially when that government issues the global reserve currency.

I had not realized that one entity (the government) could continuously print money without concern over balancing its budget (at least for a long time). A more important insight than that though, was understanding the process by which our government creates money. Since that process lies at the heart of our financial system, it must be explored first. So, let’s take a look…

In its current configuration, the US government doesn’t directly print the dollars entering our system. Instead, the first step in creating our dollars is for the US Treasury to issue a bond, which is an IOU (also referred to as a Note). These Bonds/Notes are a statement of debt (as in I Owe You money).

Using large banks as intermediaries, the Federal Reserve Bank (Fed) ‘buys’ these bonds/IOUs and issues a ‘check’ to the largest banks. In this process they create money where none previously existed. These banks accept the Fed’s ‘check’, depositing it as new dollars, then loans these new dollars into the rest of the banking system via a fractionalized reserve lending system.

Fractionalized reserve means exactly what it says – the banks create new money through loans while reserving for collateral only a fraction of the money in their account. For example, if the fractional reserve requirement is 10%, a bank holding 100 dollars can loan out 90 dollars. They are required to hold 10 dollars in reserve. In doing this, the bank creates money out of nothing. This process filters out to the entire Federal Reserve banking system, including to small community banks where most of us would take out mortgages and other loans.

In this money creation process, both the Fed and the banks create money simply by entering ledger items on a computer screen. There is no need to print physical dollar bills. Because this process multiplies money creation, and because there is only one Fed but thousands of banks, the great majority of our money is created by the smaller (and larger) banks. In normal times, the Fed creates a relatively small percentage of our total new money.

In this process, increases in money supply are primarily stimulated by the amount of new bank loans. This leads to ample money creation during boom periods. It also reflects money-supply/credit-reduction when the economy turns down, as was seen in the 2008 housing bust when many loans went into default and banks curtailed new loan generation.

It is primarily this cycle of money supply creation and destruction that causes economic booms and busts. The dynamics of this cycle are comparable to how traffic flows during a rush hour traffic backup on the freeway – repeatedly speed up, then slow down.

I grasped a much fuller understanding of this process when I came upon Mike Maloney’s Hidden Secrets of Money video series. The entire series is definitely worth watching if you want a solid understanding of how our financial system operates; however, I found Episode 4 below to be the most critical because it explains how money is created.

I learned more about our financial system in this 30-minute animated video than I learned in all my combined years in grade school, high school, college and working in industry.

You may want to watch this more than once to ensure full understanding. I did. Once you understand how this process works, you might have the same question I had, “Why this is not taught in our schools?”

Some takeaways from Mike’s Episode 4, plus additional thoughts:

All the money we use is actually debt, i.e. owed to someone else. That someone else is the Fed, since they created the money. Which is why “Federal Reserve Note” is written on all our cash dollars. In reality, all our money (except gold and silver coins) is debt owed to the Fed.

Very little of our money is cash. Most is held electronically in computers as ledger entries.

‘Bond’ is the root word of ‘bondage’.

Our currency holds value because we say it does, not because it represents anything of physical value. For this reason, we call it ‘fiat currency’. Fiat means ‘by decree’, meaning it is money because the government says it is.

There is always more debt in our debt-based money system than the amount of currency available to pay it off (because interest is constantly accruing on the outstanding debt). This requires continuous creation of new money to pay the interest.

The IRS was created after the Fed was created. Income tax did not exist and was not necessary until the Fed was created in 1913.

The debt ceiling will always be raised – until the entire fiat currency collapses (history has shown that this typically occurs during a hyperinflationary crash caused by extreme money printing – think current Venezuela).

Our founding fathers wrote into the Constitution that only gold and silver could be used as money. They did this because precious metals cannot be printed into infinity.

The Fed is owned by its regional banks, which are owned by the largest private banks, which are themselves owned by their shareholders – i.e., the Fed is privately owned (although the US President nominates, and Congress approves, its board members).

The process described in this video illustrates how an unlimited amount of money can be printed (in today’s popular terminology, this process is called Modern Monetary Theory [MMT]).

Summarizing Episode 4 of Hidden Secrets of Money: our debt-based, Federal Reserve banking system allows private bankers to create money from nothing, earn interest and dividends on that money, and we the citizens are given the right to use this money by, in essence, borrowing it (i.e. as holder of debt) and using it for trade as well as a store of value.

No State shall make any Thing but gold and silver Coin a Tender in Payment of Debts.

-United States Constitution

After years studying our current financial system, I concluded it has two fundamental weakness:

All money is created as debt owed to someone. For this reason, the money supply must always grow in order to pay the interest on the debt.

It is a fiat system not backed by any physical assets that would place a brake on its printing.

History shows that in all fiat currency systems, excess money printing leads to currency debasement, hyperinflation, and currency collapse (note Zimbabwe, Venezuela, and other examples in recent decades.)

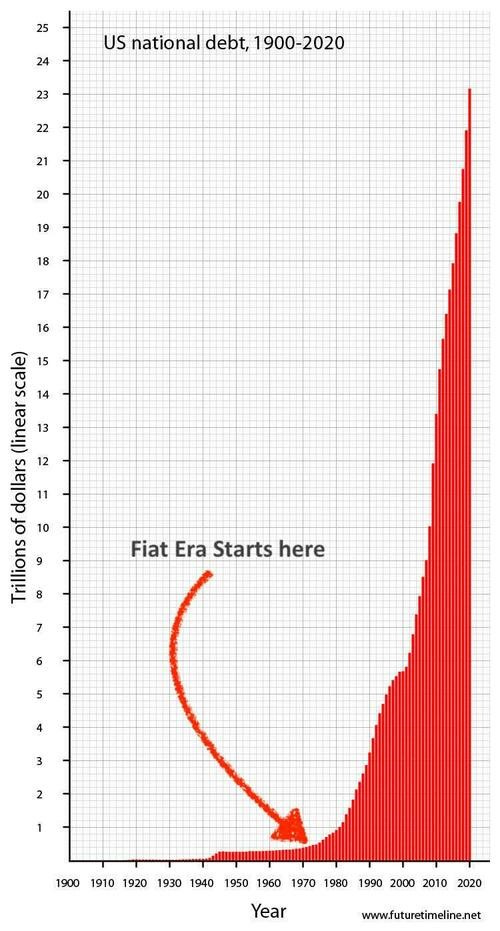

In our current debt-based fiat currency system, government debt has grown, in the view of many financial experts, to unsustainable levels. Our national debt recently exceeded $30 Trillion, adding $7 Trillion since 2020. This is only the stated government debt. This does not include unpaid liabilities such as Social Security and Medicare, nor does it include private pensions or private and student loans. In other words - we are drowning in debt.

Do you happen to know what occurred in 1971 that caused the debt curve to go parabolic? (That question will be answered in a future newsletter discussing the history of money in the USA.)

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output... A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.

-Milton Friedman, University of Chicago Nobel Prize winning economist

As I learned more about the process of money creation, I realized that the system we currently use was not created for those of us working to provide society’s needed goods and services, but was instead designed to benefit a small segment of the population (primarily the bankers), largely at the expense of the rest of us.

Nations trade with one another using what is called a reserve currency.

Investopedia.com describes a reserve currency as:

“A large quantity of currency maintained by central banks and other major financial institutions to prepare for investments, transactions, and international debt obligations, or to influence their domestic exchange rate. A large percentage of commodities, such as gold and oil, are priced in the reserve currency, causing other countries to hold this currency to pay for these goods.”

Since 1944, the US dollar has been the world reserve currency. This means that other nations trade with one another by spending dollars for goods. Since, as described in Mike Maloney’s Episode 4 video, all dollars are debt instruments, nations are actually trading with each other using US debt as the payment vehicle.

In order for enough money to be available to meet growing needs of world trade, the US must create more money – which requires creation of more debt. This configuration allows the US to create debt-based money (out of nothing), and use that money to buy goods from other countries. Other countries are willing to take the newly created money so they have monetary reserves available to spend in the international market buying goods and services from their trading partners.

Through this process, the US can buy a portion of its goods from overseas without selling any goods overseas to balance the trade. In other words, the US can operate with a trade deficit as long as the rest of the world needs US dollars as reserve currency for international trade. This gives Americans a discount on imports from other countries. French Finance Minister Valéry Giscard d'Estaing in 1965 declared this America’s “exorbitant privilege.”

Finally, I had the answer to the question that plagued me so many years! The US can have continuous trade deficits by spending printed money other countries need for trade in exchange for physical goods and services.

If I were a citizen of any country other than the USA, I would say, “That’s a racket!”

If all of this seems too complicated, I created a simplified analogy of the financial system. I call it The Financial Forest Analogy. While not perfectly accurate at describing a very complex system, it provides a general understanding of how the system works.

In the Financial Forest Analogy, the forest is the financial system, the trees and other plants are the businesses, banks, and individuals, water is money, and the government is clouds. The analogy describes two versions of the financial forest, one with and one without a central bank. (I would make it into an animated video if I had the skill to do so.) You can find it here in written form:

After reading the Financial Forest Analogy, which version would you prefer – the one with the central bank, or the one without the central bank?

Money is a vehicle for expressing our individual purpose into the world. It can be used for good, which aligns with one’s greater purpose, but when people do not recognize their greater purpose, its use can be detrimental. It is up to each of us to decide for what purposes we shall use our money.

Taking drugs and thinking that you are happy is like taking a loan and thinking you have money. Thibaut

Other nations also hold reserve currency as savings. This means many nations hold US dollars in reserve, which is fine for them as long as the dollar holds its value. Excessive printing of dollars devalues the dollar. Since the US has been on a multi-decade printing spree, other countries have been looking for a reserve currency that better maintains its value, which segues into the topic of the next newsletter –potential consequences of the trade sanctions currently being placed upon Russia.

One last thing - Substack recently launched a phone app. It allows you to view all your newsletters in one place as well as find other substack authors. Some of my favorite authors and journalists have migrated to Substack.

You can learn more about the app here. It’s free, with no ads, and easy to use.

Thank you for writing this. I am totally naïve and only recently attempting to educate myself on the matter of money. I have some saved and trying to figure out how to keep it safer. Currently, much of it is in Vanguard, aka, one of the devils.